Proposed CFPB Rules About Home Loan Data Ignore the Harms of Redlining at Our Communities’ Peril

By Aastha Uprety

June 3, 2019

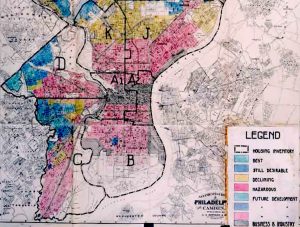

A redlined map of Philadelphia from the Home Owners’ Loan Corporation. | Source

A redlined map of Philadelphia from the Home Owners’ Loan Corporation. | Source

Earlier this year, the Consumer Financial Protection Bureau (CFPB) announced its intention to change the rules that govern how banks and other lenders collect and report home loan data. Two proposed rules would decrease the number of banks that are required to report data to the CFPB, and change the types of data lenders are required to collect while limiting public access to this data. By loosening regulations on reporting mortgage data and removing the public’s ability to easily access and analyze it, the CFPB disregards the importance of such data in combatting historical and modern-day redlining. This could make it harder to prove lending discrimination against people of color and enforce civil rights laws, and could ultimately exacerbate the racial wealth gap.

Redlining is a practice that was instituted in the 1930s by the government-sponsored Home Owners’ Loan Corporation to indicate where it was “safe” to issue mortgages by color-coding neighborhoods on maps. Neighborhoods that were typically deemed more “risky” were marked in red — and were predominantly made up of African Americans. The denial of home loans to minority communities led to segregation and gutted Black Americans’ ability to gain wealth. While such discriminatory lending was banned by the Fair Housing Act of 1968 (FHA), redlining still exists today.

In the United States, wealth is closely tied to homeownership. By denying home loans to certain communities and thus preventing those communities from owning homes and building wealth, redlining has contributed to a widening racial wealth gap where Black Americans on average hold just 10 percent of the wealth of white Americans. In Washington, D.C., the disparity is even more stark; here, the net worth of white households is 81 times as much as that of Black households. According to an investigation from Reveal, the homeownership gap between whites and African Americans is now wider than it was during the Jim Crow era—despite the passage of the FHA more than five decades ago.

The proposed rules from the CFPB concern the Home Mortgage Disclosure Act of 1975 (HMDA), a law that requires financial institutions to publicly report data on mortgage loan applications. Among other purposes, HMDA helps the public identify potential discrimination in lending.. Following decades of redlining, HMDA was one tool meant to end the denial of loans to African Americans and close the gap in homeownership between white and Black Americans. While these problems are still rampant today, publicly available data on lending is one way that advocates can identify discrimination and encourage enforcement action against discriminatory banks.

HMDA has been modified and expanded upon since it was first passed, and in 2015, the Obama administration added new required reporting categories, including ethnicity data to supplement and disaggregate the race data that was already collected. The CFPB is now proposing to roll back Obama-era regulations, raise the reporting threshold so that banks that issue fewer loans are exempt from reporting, and shut down the online portal that allows the public to access HMDA data. The online portal currently says “this tool will sunset in the coming months” and suggests that it will be replaced by a different tool.

The CFPB claims that these new rules will ease the regulatory burden that banks must deal with, but many of the smaller institutions and credit unions that would become exempt from reporting by this rule service low-income communities more than major banks do – so accountability is paramount.

This regression in transparency, particularly of public access to the data, could have dire consequences. In April, nine U.S. Senators expressed their concern over the removal of the HMDA data explorer tool in a letter to CFPB Director Kathleen Kraninger. The letter explains how public access to HMDA data allows “advocates, policymakers, and journalists to understand which loan products are or aren’t being offered across communities,” making “HMDA a more effective tool for understanding and combating inequality in our modern lending markets.”

A 2018 Reveal investigation used HMDA data to find that banks continue to redline and deny loans to Black, Latino, and other minority applicants. In 48 cities, Black applicants were denied mortgage loans at significantly higher rates than white applicants, and in 25 cities Latino applicants faced the same disadvantage. In Washington D.C, the study found that Black, Latino, Asian, and Native American applicants were all more likely to be turned away than their white counterparts.

Uncovering such disturbing trends in redlining and lending discrimination will be undeniably more difficult if the CFPB loosens regulations on lenders’ obligation to collect and report data and hinders the public’s ability to access and analyze the data. The proposed rules signal a step back from transparency, regulation, and enforcement, and represent the abandonment of equal housing principles that were adopted to pull our country out of deep racial inequality.

The proposed rules are currently on the Federal Register: Notice of Proposed Rulemaking (RIN: 3170-AA76) has a notice-and-comment period through June 12 and the Advance Notice of Proposed Rulemaking (RIN: 3170-AA97) has a comment period through July 8. You can submit a public comment in opposition to the rules at the links above. Here are some tips:

Introduce yourself, explain the rule’s relevance to you, and make clear which rule you are commenting on.

Explain the significance of the current regulations regarding home loan data, including but not limited to the benefits of requiring lenders to report data, the importance of the required categories, and the importance of public access to such data. This will depend on which rule you comment on. Include evidence where you can.

Conclude with a summary of your points.

For more, see How To Effectively Comment On Regulations from the Brookings Institution.

If you believe you may have experienced discrimination in housing, you can contact the Equal Rights Center. To report your experience, please call 202-234-3062 or email info@equalrightscenter.org.